MA ST-7R 2018-2025 free printable template

Show details

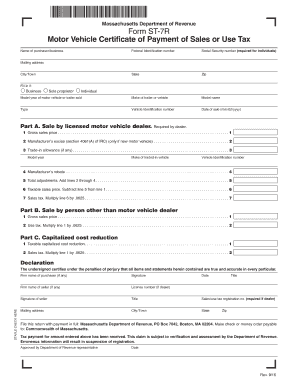

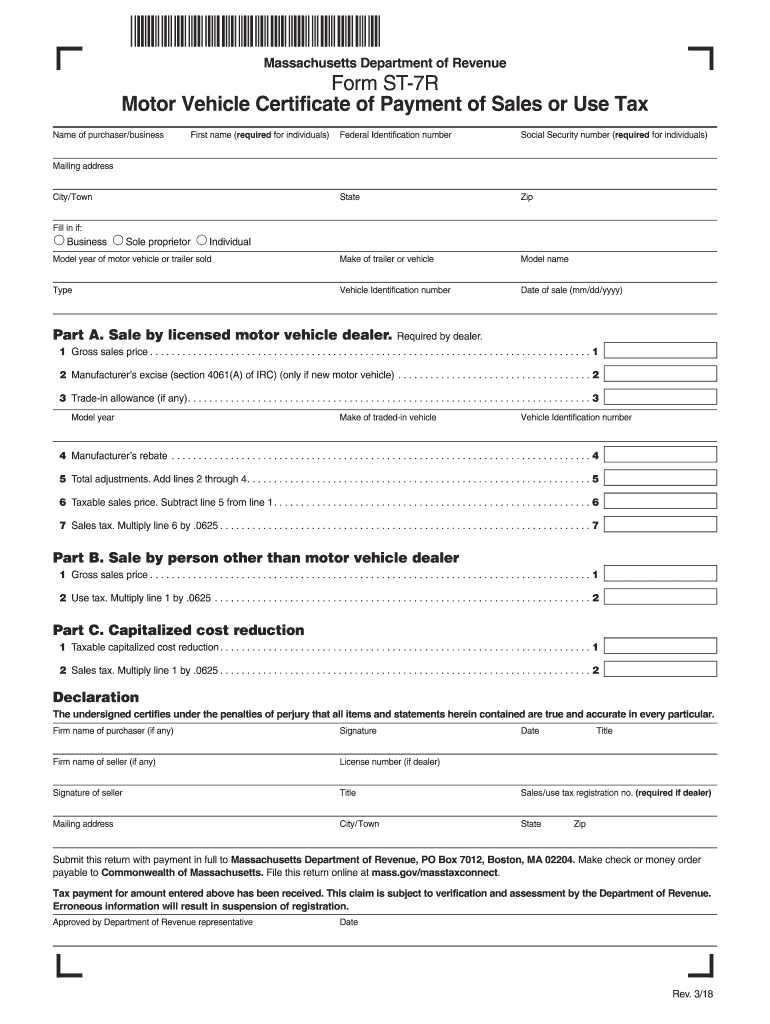

Massachusetts Department of Revenue Form ST-7R Motor Vehicle Certificate of Payment of Sales or Use Tax Federal Identification number Social Security number required for individuals State Zip Model year of motor vehicle or trailer sold Make of trailer or vehicle Model name Type Vehicle Identification number Date of sale mm/dd/yyyy Name of purchaser/business Mailing address City/Town Fill in if Business Sole proprietor Individual Part A. Sale by licensed motor vehicle dealer. Required by...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ma st 7r form

Edit your massachusetts st 7r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ma st7r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit the ST7 form online

1

Create an account. Click 'Start Free Trial' if you are a new user and follow the prompts to establish your profile.

2

Upload the document. Select 'Add New' to upload your ST7 form PDF from your device, internal email, the cloud, or by providing a URL.

3

Edit the form. Adjust the layout by rearranging and rotating pages, adding or modifying text, and inserting new elements. Once complete, click 'Done.' You can also merge, split, lock, or unlock your files using the Documents tab.

4

Save your changes. Select your document from the records, then use the right toolbar to choose your preferred export option: save in various formats, download as a PDF, email it, or save it to your cloud storage.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA ST-7R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out massachusetts st 7r tax form

How to fill out st7 form

01

Begin by obtaining the fillable ST-7 form from the Massachusetts Department of Revenue website or your local tax office.

02

Fill out the ST-7 form by entering your personal information at the top, including your name, address, and Social Security number.

03

Indicate the type of exemption you are applying for in the designated section.

04

Provide details about your business, such as its name, address, and federal employer identification number (EIN).

05

Specify your entity type by checking whether you are a corporation, partnership, or sole proprietorship.

06

Complete the sales tax registration number section, which is often required to establish your tax authority.

07

Review the eligibility criteria for the exemption you are claiming to ensure you meet all requirements.

08

Save a copy of the completed ST-7 form PDF for your records.

09

Submit the printable ST-7 form to the Massachusetts Department of Revenue either via mail or electronically as necessary.

Who needs st7 form?

01

Businesses Seeking Sales Tax Exemption: Businesses that intend to obtain a sales tax exemption in Massachusetts must complete the fill out ST-7 form.

02

Nonprofit Organizations: Nonprofit organizations that qualify for tax-exempt status are also required to use this form.

03

Purchasers of Exempt Goods: Persons purchasing certain goods and services that fall under sales tax exemptions as stated by state law.

04

Resellers: Resellers aiming to buy items for resale without incurring sales tax are eligible to fill out the ST-7 form online.

Video instructions and help with filling out and completing ma gov masstaxconnect st7

Instructions and Help about st7 form

Fill

ma form st 7r

: Try Risk Free

People Also Ask about massachusetts st 7r certificate print

How do I verify my Massachusetts resale certificate?

Businesses which receive a Form ST-4 can visit MassTaxConnect to find out if a potential buyer is registered with DOR to collect sales or meals tax.

Do you pay sales tax on a private car sale in Massachusetts?

DMV or State Fees If a car dealer or lessor sells you the car, it's a sales tax. If it's a private sale it's called a use tax. Both are 6.25%. There are some exceptions to the use tax.

How do I get my St 1 form in Massachusetts?

After you register with DOR, you will receive a Sales and Use Tax Registration Certificate (Form ST-1) for each business location. The form must be displayed on the business premises where customers can easily see it.

How do I get a ST 1 form in Massachusetts?

Forms may be obtained by calling the Department of Revenue's forms supply center at (617) 887-MDOR (6367) or toll free within Massachusetts (800) 392-6089.

How do I get a copy of my mass sales tax certificate?

You can easily acquire your Massachusetts Sales and Use Tax Registration Certificate online using the MassTaxConnect website. If you have quetions about the online permit application process, you can contact the Department of Revenue via the sales tax permit hotline or by checking the permit info website .

How do I pay sales tax on a trailer in MA?

Every buyer who is not required to register or title the vehicle in Massachusetts, must file a completed Form ST-7R: Motor Vehicle Certificate of Payment of Sales or Use Tax by the 20th day of the month after the buying, transferring, or using the vehicle, and pay any applicable tax to DOR or the RMV.

How do I calculate sales tax on a car in Massachusetts?

The Massachusetts sales tax rate on cars is 6.25 percent. To figure out how much the sales tax is, multiply the price of the car by 0.0625. If you bought a car for $10,000, for instance, the sales tax would be $625.

How do I pay sales tax in Massachusetts?

You have several options for filing and paying your Massachusetts sales tax: File online – File online at the Massachusetts Department of Revenue. You can remit your payment through their online system. File by mail – Fill out and mail in form ST-9. AutoFile – Let TaxJar file your sales tax for you.

How much is tax title and registration in Massachusetts?

How much does it cost to register your vehicle in Massachusetts? In 2021, registering a normal private passenger vehicle in Massachusetts costs $60 and is good for 2 years. In MA, the Certificate of Title fee is $75. You'll also need to have your vehicle inspected, which costs $35.

Can you deduct car sales tax in Massachusetts?

You can deduct sales tax on a vehicle purchase, but only the state and local sales tax. You'll only want to deduct sales tax if you paid more in state and local sales tax than you paid in state and local income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send the ST7 form for eSignature?

When you're ready to share the ST7 form, you can easily email it to others and receive the signed document back. You may send your ST7 form pdf through email, fax, text message, or USPS mail, or you can notarize it online. All of this can be done without leaving your account.

How do I edit the ST7 form online?

pdfFiller allows you to modify your ST7 form. Upload your ST7 form online to the editor and make changes with just a few clicks. The editor enables you to black out, type, and erase text in your PDF. You can also add images, sticky notes, text boxes, and more.

Can I edit the ST7 form on an iOS device?

Download the pdfFiller app for iOS to create, edit, and share the ST7 form from your phone. You can find it on Apple's store and get it set up quickly. A free trial is available, as well as subscription plans to suit your needs.

Fill out your MA ST-7R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

st7r is not the form you're looking for?Search for another form here.

Keywords relevant to mass st 7r fillable

Related to massachusetts st7r

If you believe that this page should be taken down, please follow our DMCA take down process

here

.